The Maryland State Retirement and Pension System Earns Historic 26.7% During FY 2021

Fund grows more than $13 billion to nearly $68 billion

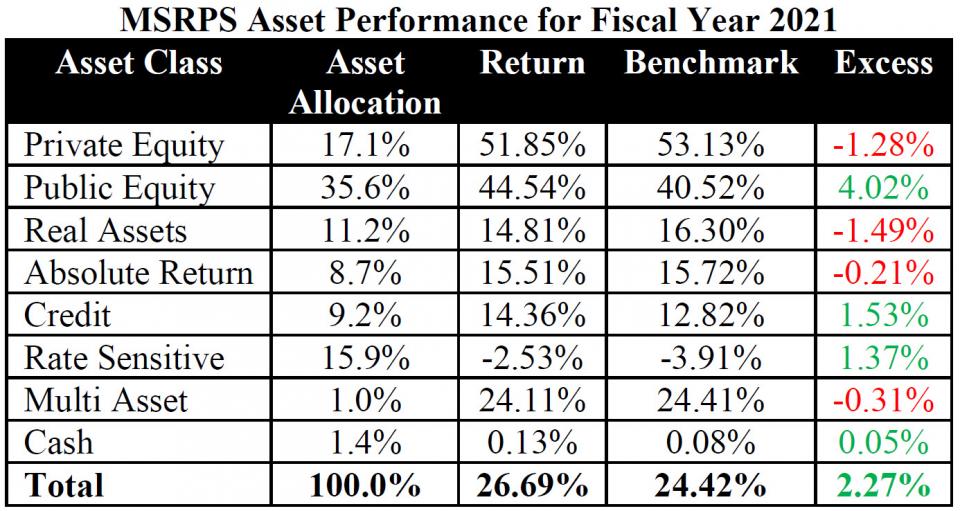

Baltimore, MD (August 10, 2021) — The Board of Trustees of the Maryland State Retirement and Pension System (MSRPS) today announced that its portfolio returned a record-setting 26.7%, net of fees, on investments for the fiscal year that ended June 30, 2021. The fiscal year earnings far exceeded the System’s 7.40% assumed actuarial return rate and surpassed its policy benchmark of 24.41 by 230 basis points. The fund’s performance raised the System’s assets to $67.9 billion, an increase of $13.3 billion over the prior fiscal year.

The performance of the fund over 10-year, 5-year, 3-year and 1-year periods are all above the 7.4% return assumption at 8.2%, 10.7%, 11.8% and 26.7%, respectively.

“It was an extraordinary year for the performance of System assets, the best in 35 years,” said Andrew C. Palmer, Chief Investment Officer. “The attractive investment opportunities provided by the pandemic and subsequent monetary and fiscal policy responses are apparent in the rearview mirror but were not always clear in real time. Fortunately, working with the Board and the investment staff, the System was able to fully participate in the very strong returns available in most markets. Importantly, the System maintained its moderate risk posture and portfolio implementation, resulting in impressive risk-adjusted returns as well.”

“The Board of Trustees has carefully designed a well-balanced portfolio of investments to meet its obligations to beneficiaries,” said State Treasurer Nancy K. Kopp, Chair of the Maryland State Retirement and Pension System Board of Trustees. “The last two years have demonstrated the overall effectiveness of the Board’s investment strategy, preserving value during the volatile market environment resulting from the Covid-19 pandemic and fully participating in the strong growth as economies rebounded. It’s important to remember that we are long-term investors who need to balance the liquidity requirements to meet current benefit payments with the objective of generating returns for future benefit payments over an investment horizon that stretches across decades. Over the last ten years, investment returns have averaged 8.2%, exceeding the plan’s expected rate of return and consistent with the Board’s investment policy.”